Charging as a Service (CaaS): Why it’s the Future of EV Infrastructure

Electric vehicles are no longer a niche — they’re mainstreaming fast. But one bottleneck keeps repeating in boardrooms, mall-owner emails and municipal plans: who pays for, installs, runs and maintains the chargers? Charging as a Service (CaaS) answers that question by turning EV chargers into a managed utility — and it’s reshaping how sites (malls, parking lots, fleets, workplaces) add charging without the headaches.

What is Charging as a Service (CaaS)? — simple definition

Charging as a Service (CaaS) is a turnkey offering where a third-party provider owns, installs, operates and maintains EV charging infrastructure on behalf of a host (property owner, fleet operator or municipality). Instead of buying hardware and paying large upfront capital expenditures, hosts subscribe to a service (monthly fee, pay-per-use or revenue-share) and outsource technical operations, payments, energy management and maintenance.

The main CaaS business models (how vendors make money)

CaaS is flexible — different contracts suit different hosts. The common business models are:

- Subscription / OPEX model — Host pays a fixed monthly fee covering hardware, installation, software, maintenance and operations. Great for predictable budgets.

- Pay-per-use / Transaction model — Host or driver pays per kWh, per session, or per minute. Provider returns a share to the host or keeps the fee as revenue. Good for public/retail sites.

- Revenue share / Partnership model — Provider installs and operates chargers; host gets a cut of charging revenue (or a fixed rent). Lowers barrier for property owners who want passive income.

- Managed service + Fleet contracts — Fleet operators take on time-of-use pricing, reservation, energy scheduling and demand management; provider runs charging and bills per vehicle or per kWh. Popular with logistics/fleet electrification.

- Hybrid & financing variants — Combinations: initial subsidy + ongoing subscription, or hardware lease + services. OEMs and utilities sometimes bundle energy or renewable credits into contracts.

Why CaaS accelerates EV charger deployment — the core benefits

- Removes up-front capital barrier (CapEx → OpEx)

Hosts don’t need to buy expensive chargers or pay for electrical upgrades; they pay a predictable operational fee instead. That dramatically lowers the friction for malls, hotels, workplaces and parking operators to add charging. - Turnkey expertise & faster time-to-live

CaaS vendors handle permits, site surveys, electrical upgrades, installation, network software and integrations — reducing deployment timelines and technical risk. - Better uptime & professional maintenance

Dedicated operators provide SLAs, remote monitoring and proactive maintenance, improving charger reliability (a major user pain-point). - Energy & load management

Providers integrate smart energy management (peak shaving, demand response, V2G-ready architectures) so chargers don’t blow the site’s electricity budget. - Flexible commercial arrangements

Hosts can choose revenue-share, fixed rent or subscription models depending on risk appetite and expected utilization. - Scalability

As EV adoption rises, hosts can scale chargers in phases — adding capacity only when utilization justifies it.

(These practical benefits are repeatedly cited in industry glossaries and market analyses of CaaS offerings.)

Trade-offs & cons — what to watch out for

Longer-term cost vs buying: Depending on utilization and contract terms, subscription costs over many years can exceed a one-time purchase. Careful modelling is required.

Vendor lock-in: Proprietary networking, payment systems or long contracts can lock hosts into a single provider for years. Negotiate exit, interoperability and data access clauses.

Revenue unpredictability in early years: For retail hosts expecting revenue share, low initial EV adoption may mean slower returns.

Regulatory and subsidy complexity: Public incentives or utility rules may favour ownership or specific architectures; contract design should anticipate policy changes.

Operational dependency: The host hands operational control to a third party; SLA details (uptime, response time for repairs) must be explicit.

Grid impact & upgrade costs: While providers often absorb electrical upgrades, in some contracts hosts may still face shared or passed-through utility upgrade costs.

How CaaS specifically lowers barriers for host sites (malls, parking lots, workplaces)

- No CapEx shock — instead of budgeting large one-time purchases and upgrades, hosts convert the cost into steady, forecastable operating expenses. That’s attractive to landlords and malls where capex budgets are tightly allocated.

- Reduced operational burden — hosts don’t need onsite technicians or software teams; the CaaS vendor takes care of ROIs, payments, customer support and compliance.

- Faster approvals & deployment — experienced CaaS providers know local permitting and utility interconnection patterns and can move faster.

- Monetisation options — hosts can earn passive income through revenue-share while offering a valuable amenity to customers.

- Future-proofing — providers can replace or upgrade hardware as standards evolve (e.g., faster chargers, contactless payments) without re-investment from the host.

These levers make it far easier for a shopping centre or a municipal parking operator to “dip a toe” into EV charging and scale later when demand grows.

Global case studies (real-world examples)

ChargePoint — “CPaaS” (ChargePoint as a Service)

ChargePoint offers a managed service that bundles hardware, networking, payments and fleet management into programmatic offers for businesses and fleets. CPaaS gives enterprises predictable costs and centralised management. This model has been widely referenced as an industry blueprint for enterprise CaaS.

EVgo, Electrify America and ChargePoint — shared lessons

Large fast-charging networks in the U.S. combine roaming, interoperability and site partnerships. Operators deploy charging at retail, grocery and highway locations using commercial models that mix host payments, government grants and revenue-share. These rollouts show that combining public funding with private CaaS contracts accelerates geographic coverage and reliability. (Analysts and market reports highlight this combined approach.)

India case studies & landscape

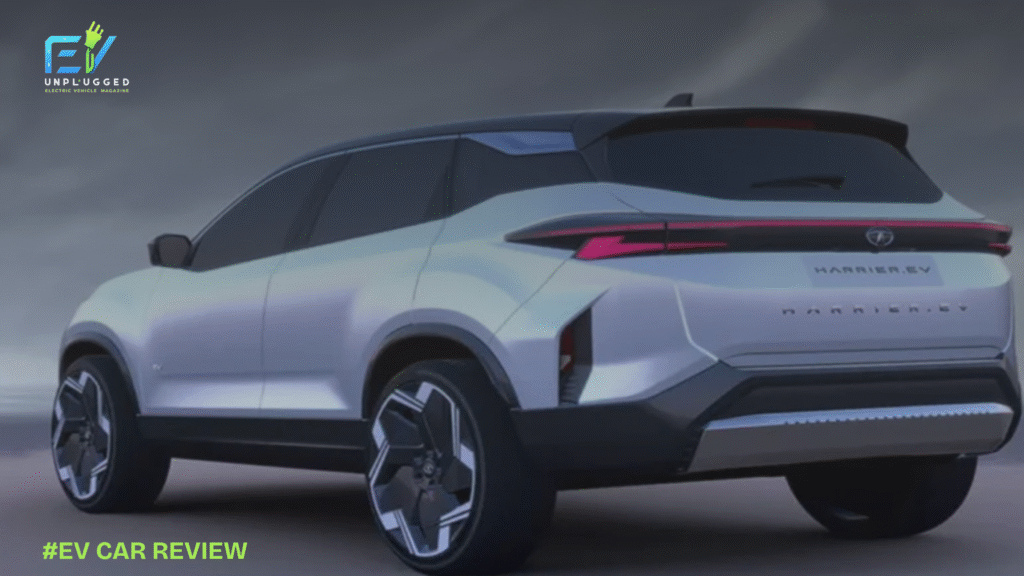

Tata Motors / Tata Power / utility & OEM-led expansion

India’s OEMs and utilities are rapidly expanding charging networks. Tata Motors — among others — announced aggressive plans to scale charging points and ‘Mega Charger’ hubs to address range anxiety; utilities like Tata Power have already installed tens of thousands of chargers across homes and public sites. In India, CaaS-style offerings are emerging as OEMs, utilities and private CPOs (Charge Point Operators) partner with malls, fuel stations and fleets to deploy chargers without heavy upfront investments from hosts.

Key India observations

- Large private fuel retailers and oil PSUs (Indian Oil, BPCL, HPCL) and utilities are partnering to roll out chargers at fuel stations and public spaces.

- Fleet electrification (2/3-wheelers, taxis, last-mile logistics) is a leading use case for managed charging services because fleets value predictable operations and OPEX models.

- Local CaaS providers and integrators tailor contracts to accommodate grid constraints, rooftop solar pairing and demand-charge mitigation — a crucial capability in many Indian cities.

(Industry reports show the India CaaS market growing rapidly with strong CAGR forecasts.)

Practical checklist for hosts considering a CaaS partnership

Clarify total cost of ownership: request TCO scenarios (3, 5, 7 years) for subscription vs buy.

SLA & uptime: define uptime targets, fault response times and penalties.

Interoperability & open standards: insist on OCPP support, roaming and data portability.

Revenue split and payment flow: set transparent reporting cadence and settlement terms.

Exit & upgrade clauses: how are hardware replacements handled? Is there buyout/transfer at contract end?

Energy management & grid upgrades: who pays for distribution upgrades or demand-charge mitigation systems?

Data & privacy: who owns driver/usage data, and can host access anonymised analytics?

Regulatory/subsidy capture: ensure the vendor will apply for available grants or subsidies on the host’s behalf, if applicable.

The market outlook (short forecast)

Market analyses from multiple research firms indicate strong CAGR for CaaS over the rest of the decade as fleets electrify, retail hosts adopt charging amenities and governments subsidise infrastructure. Expect growth in bundled energy services (solar + storage + CaaS), fleet-specific offerings and utility-partnered CaaS programs.

Final take: why CaaS is the logical next step

CaaS converts EV charging from a capital problem into a managed service — the same progression we saw in telecom (leased lines → managed connectivity) and in IT (on-prem → SaaS). For host sites that want to add chargers with low risk, predictable costs and professional operations, CaaS is the practical, scalable route. Policy alignment, stronger interoperability standards and competitive CaaS offerings will only speed adoption — making CaaS not just an attractive option but, increasingly, the default path to deploy EV infrastructure.

English

English