EV Financing in India: Investment Opportunities in 2025

India’s electric vehicle (EV) revolution is shifting gears. In FY2025, EV sales crossed 2 million units, driven largely by the rapid adoption of electric two-wheelers. But behind the scenes, another major force is powering this growth: EV financing.

From low-interest loans to green bonds and lease-based investments, EV finance in India has become a hotbed of opportunity. For investors, startups, and lenders alike, the question is no longer if to invest—but how to make the most of the rising tide.

Why EV Financing Is Gaining Ground in India

1. Government Incentives and Policy Push

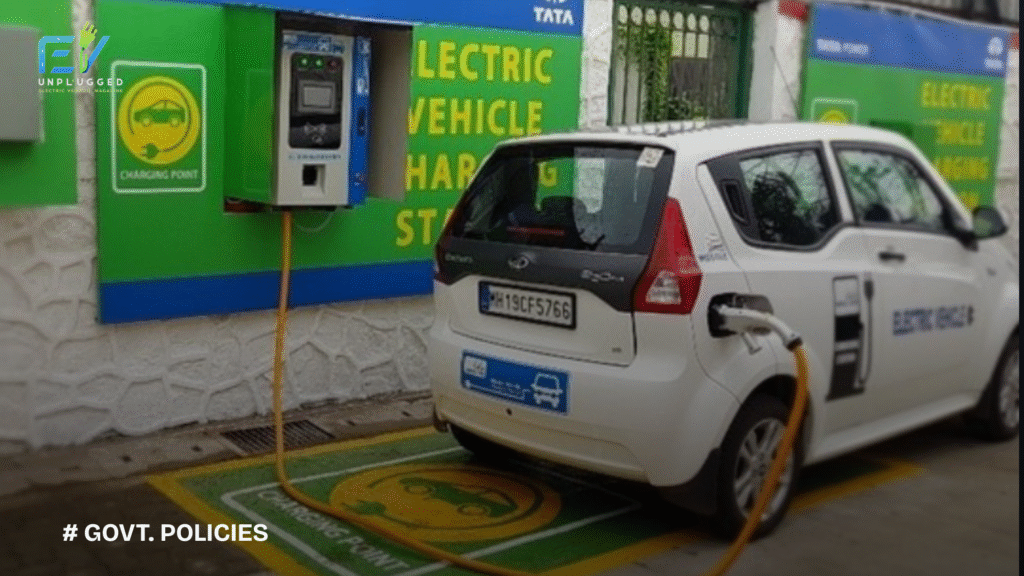

The Indian government is actively pushing for faster EV adoption. In the Union Budget 2025-26, several policy decisions were made to support both buyers and manufacturers. The PM E-Drive Scheme, for example, offers subsidies based on battery capacity—₹5,000 per kWh (capped at ₹10,000)—to lower the cost of electric two-wheelers.

At the same time, the government has allocated billions towards building charging infrastructure and supporting EV startups. This combination of demand and supply-side support is a strong signal to investors looking for electric vehicle investment opportunities in India.

2. Growing Demand for Affordable Financing

While the cost of EVs is decreasing, affordability remains a barrier. That’s where EV loan financing steps in. Digital lenders and fintech startups are making EV ownership easier with fast approvals, minimal paperwork, and EMI options—even for underserved or rural customers.

3. Investor Appetite for Green Assets

As environmental concerns rise, investors are seeking exposure to green and sustainable assets. EV-backed securities, green bonds, and electric mobility funds are gaining popularity as low-risk, high-impact alternatives in the Indian market.

Top EV Financing Investment Opportunities in 2025

1. EV Leasing and Subscription Models

Not everyone wants to own an EV. Subscription services and lease-to-own models are growing fast—especially in urban areas and among gig workers. This creates stable, recurring revenue streams for platforms and investors in EV leasing startups.

2. Green Bonds & EV-Backed Securities

Green bonds in India are being used to fund everything from EV manufacturing to infrastructure. Platforms like Grip Invest are allowing retail investors to fund EV leasing pools and earn fixed returns.

3. Digital EV Loan Platforms

Startups like RevFin and Mufin Green Finance are building digital-first lending platforms tailored for EV buyers, including those without strong credit histories. This niche is becoming increasingly attractive to VCs and angel investors.

Key Players in India’s EV Financing Ecosystem

RevFin – Specializes in digital lending for electric two- and three-wheelers.

Grip Invest – Offers retail investors access to EV lease investments.

Mufin Green Finance – A non-banking financial company (NBFC) focused entirely on EV loans.

Ola Electric – Partnering with banks to offer affordable vehicle loans alongside their scooter sales.

Risks and Considerations

Before diving into EV finance investments, it’s essential to understand the landscape:

- Policy Dependency: Most EV demand is still tied to subsidies. Any reduction or delay in incentives can hit demand.

- Loan Defaults: As lending expands to underserved populations, default risks can rise—especially if resale values drop.

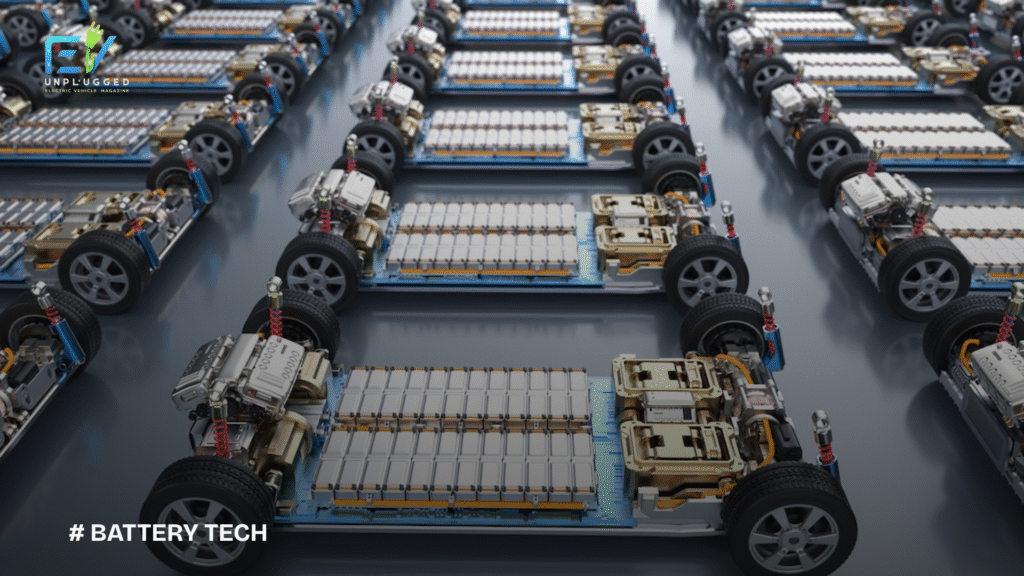

- Technology Risk: A sudden breakthrough in battery tech could make older EV models obsolete, reducing the value of financed vehicles.

How to Invest in EV Financing in India

You can start with as little as ₹10,000 through platforms offering fractional EV leasing investments or consider:

- Investing in green bond mutual funds

- Participating in EV-focused VC funds

- Backing fintech startups building credit solutions for electric mobility

Conclusion

The electric vehicle wave is here—and EV financing in India is one of the smartest ways to ride it. Whether you’re an individual investor, fintech enthusiast, or institution looking for exposure to green tech, the EV finance market offers a blend of stability and innovation.

English

English