Reality Check: Why Heavy-Duty Trucks Aren’t Ready for Full EV Mandates

As governments push for zero-emission trucking, commercial fleets face stark reality: current electric truck mandates exceed the readiness of technology, infrastructure, and economics. This article explores key challenges backed by credible sources.

Infrastructure Bottlenecks

One of the most critical and often underestimated barriers to the electrification of heavy-duty trucking is the lack of adequate charging infrastructure. Unlike passenger EVs, electric trucks—especially Class 7 and 8 vehicles—have high power demands and unique operational requirements that today’s infrastructure simply cannot support at scale.

1. High Power Requirement

Heavy-duty electric trucks typically require chargers in the range of 350 kW to over 1 MW to refuel in a reasonable timeframe. This is several times more than the 7–22 kW used for passenger EVs or even the 150–250 kW found in fast-charging car stations. Such high-powered equipment demands robust grid connections, transformers, and substation capacity that most locations currently lack.

Example: A single depot with 50 electric trucks can require more electricity than a large shopping mall. According to a report from the North American Council for Freight Efficiency (NACFE), one charging site could need as much as 20 MW, equivalent to the power demand of an entire small town.

2. Slow Permitting and Utility Coordination

Setting up charging infrastructure isn’t just about installing hardware. It involves:

- Obtaining multiple municipal permits

- Coordinating with local utility companies

- Upgrading substations and transformers

- Ensuring long-term grid stability

These processes can take 12–36 months, which is far slower than the adoption rate mandated by many zero-emission regulations. Utilities often have long lead times to build out new infrastructure, especially in remote or industrial areas where many logistics hubs are based.

In fact, in California—a leader in EV adoption—truck fleet operators have reported waiting over two years just to get transformer upgrades approved.

3. Depot vs. On-Route Charging Gap

Most electric truck deployments will start with overnight depot charging, but long-haul trucks need on-route fast chargers to support extended range. These charging corridors are still in their infancy. While passenger EVs benefit from a growing public charging network, there is no national network for heavy-duty vehicles with pull-through access, rest zones, and megawatt charging stations (MCS standard is still in pilot).

As of 2025:

- Less than 1% of public charging stations in India, the U.S., or Europe support heavy commercial vehicles.

- Existing stations are often not designed for truck access or turnaround radius.

4. Cost of Infrastructure

Installing high-capacity chargers is expensive. Beyond the hardware, costs also include:

- Civil works (trenching, wiring)

- Transformer upgrades

- Energy storage (for peak shaving)

- Utility demand charges

According to industry estimates, infrastructure costs per electric truck can range from ₹15 lakh to ₹50 lakh (USD $20,000 to $60,000). This makes large-scale electrification financially risky for private fleet operators without significant subsidies.

5. Grid Stability Concerns

Imagine a scenario where a fleet of 100 e-trucks begins charging at 7 PM. This sudden spike could:

- Trip local transformers

- Cause grid instability in urban zones

- Increase peak-time energy costs

To manage such loads, fleet operators would need energy management systems (EMS), on-site batteries, or solar-plus-storage setups—all of which increase capex and require new operational skillsets.

Tech & Engineering Limits

- While electric vehicle (EV) technology has matured rapidly for passenger cars and light commercial vehicles, it faces significant engineering hurdles when scaled to heavy-duty trucks. These challenges aren’t merely about increasing battery size—they involve deep systemic issues that impact safety, performance, range, and payload capacity.

1. Battery Weight vs. Payload Trade-Off

Heavy-duty trucks operate on tight weight and efficiency margins. Adding batteries—often weighing several tons—dramatically impacts a vehicle’s gross vehicle weight rating (GVWR) and payload capacity.

Example: A diesel Class 8 truck might carry up to 18–20 tons of cargo. An equivalent battery-electric truck with a 500–800 kWh battery could weigh up to 3–5 tons more, reducing its payload or requiring special regulatory exemptions.

This becomes a critical concern for sectors like logistics, mining, and long-haul freight, where every kilogram of payload matters for profitability.

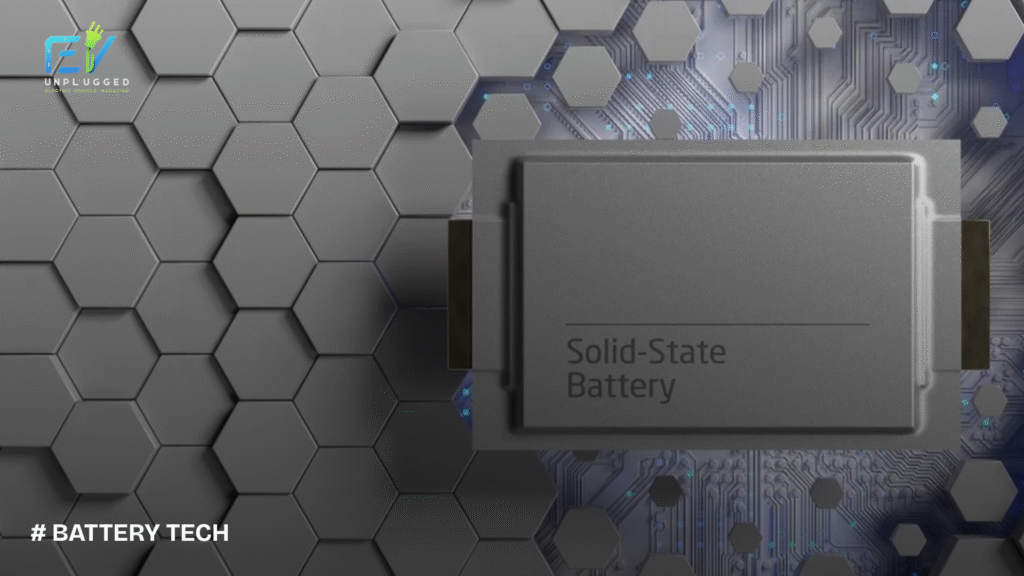

2. Thermal Management & Battery Safety

Heavy-duty trucks endure extreme operating conditions—long distances, high torque, variable terrain, and constant braking. This puts enormous thermal strain on battery packs.

Lithium-ion batteries need advanced thermal management systems (TMS) to avoid overheating or degradation.

Overheating can cause thermal runaway, a major safety concern in confined or high-load vehicles.

Some OEMs are experimenting with liquid cooling and phase-change materials, but these technologies add complexity and cost.

3. Range and Efficiency Limitations

Even with large battery packs, most electric trucks today offer a real-world range of 150–250 miles (240–400 km)—suitable only for urban and regional routes. Long-haul operations (>500 miles per day) remain unviable unless major advances in:

– Battery energy density.

– Megawatt charging.

– On-route infrastructure.

are achieved. Unlike cars, trucks don’t have the luxury to “stop and charge for an hour” without disrupting delivery timelines and fuel economics.

4. Chassis Design & Integration

Trucks aren’t built like cars—every inch of the chassis is optimized for cargo space, fuel tanks, and axle load. Retrofitting or designing an electric drivetrain often requires:

– Redesigning the undercarriage to fit batteries.

– Rebalancing weight for axle compliance.

– Modifying suspension and brake systems for added mass.

This adds complexity for OEMs and bodybuilders, especially in custom-use cases like refrigerated trucks, tankers, or tippers.

5. Component Durability

Electric drivetrains in trucks must withstand much higher loads and duty cycles than in cars:

– Continuous high-torque output for heavy cargo.

– Regenerative braking stress on motors and power electronics.

– Long idling or stop-go cycles in ports, warehouses, and highways.

Battery performance, inverter durability, and motor efficiency degrade faster in such demanding conditions unless purpose-built engineering solutions are developed—many of which are still in pilot or R&D phase.

6. Lack of Standardization

Unlike diesel trucks that follow well-established component and service standards, the electric truck ecosystem is fragmented:

– Different voltage architectures (400V vs. 800V vs. 1000V+).

– Non-uniform battery configurations and charging connectors.

– Limited cross-OEM compatibility in diagnostics and servicing.

This limits the ability to scale production, create economies of scale, or simplify maintenance for fleet operators.

Economic Hurdles

- High capex: Battery-electric heavy-duty trucks cost up to $400k—significantly higher than diesel counterparts.

- TCO not yet parity: Even with incentives, total cost of ownership (TCO) remains higher due to upfront costs and grid upgrades, according to RFF and other analysts .

Policy vs. Practicality

- Mandates such as New York’s Advanced Clean Trucks (ACT) rule face pushback due to “nearly impossible” infrastructure and cost hurdles; lawmakers are requesting a delay to 2027

- California has paused its big-rig zero-emission mandate citing limited technology readiness

Global Landscape

- Europe & U.S.: EV mandates aim for 50% of heavy-duty sales to be zero-emission by 2035, but infrastructure and supply chains lag.

- Australia: Volvo highlights inconsistent state regulations and calls for national strategy—while electric trucks are more expensive upfront yet cheaper to run long-term

Conclusion & Outlook

Heavy-duty EV mandates are pushing legal and regulatory boundaries, but the charging infrastructure, battery tech, and commercial economics aren’t there yet. Concerted efforts—public-private partnerships, targeted investment in grid and depot charging, and extended compliance timelines—are essential to make electric trucking viable.

English

English