Top Investment Opportunities in the EV Sector (2025 Guide)

The electric vehicle (EV) sector is reshaping global transportation, and for investors, it’s a goldmine of opportunity. With government incentives, climate goals, and booming demand driving the market, the time to explore EV investment opportunities is now.

According to the International Energy Agency (IEA), EV sales surged to over 14 million units in 2023—a 35% increase from 2022. Projections suggest that by 2030, over 60% of new car sales could be electric. This shift is not a phase—it’s a fundamental market transformation.

So where should smart investors focus? Let’s break down the top electric vehicle investment opportunities in 2025, with key players, trends, and tips on how to invest wisely.

Why Invest in the Electric Vehicle Industry?

The push for clean energy has made the electric vehicle industry a top priority for both governments and private investors. There are three major reasons to consider investing:

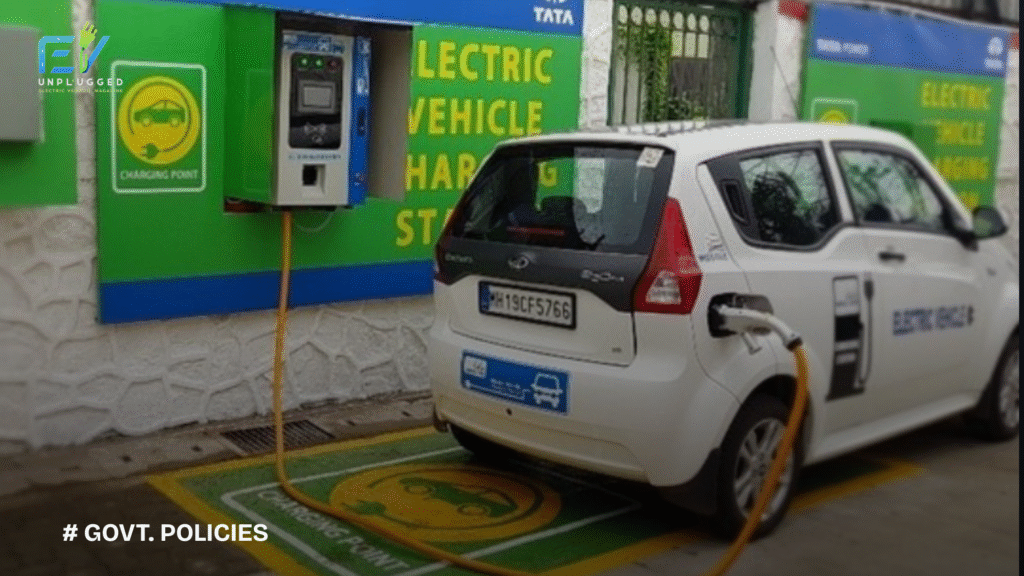

1. Government Support and Legislation

Policies like the U.S. Inflation Reduction Act and the EU’s Green Deal provide tax credits, subsidies, and infrastructure funding to fast-track EV adoption. These initiatives boost both demand and supply, creating a favorable environment for EV stocks to thrive.

2. Consumer Demand for EVs

Consumers are choosing EVs for lower fuel costs, smoother performance, and sustainability. Automakers are responding by phasing out gas vehicles and expanding EV production. This shift fuels growth in electric vehicle stocks and related markets.

3. Innovation and Disruption

Technological advances—especially in EV battery technology and autonomous driving—open up entire new sectors to invest in. Companies leading in these fields often deliver the strongest long-term returns.

Top EV Investment Opportunities in 2025

1. Invest in EV Manufacturers

For direct exposure to the EV boom, look to leading automakers:

- Tesla (TSLA) – The pioneer in EVs, Tesla dominates the U.S. market and continues to scale globally.

- BYD (BYDDF) – The biggest EV company in China and a global competitor with lower-priced models.

- Rivian (RIVN) – Focused on electric trucks and SUVs, Rivian has big contracts with Amazon and a strong brand.

- Lucid Motors (LCID) – Known for its luxury EVs and advanced battery range technology.

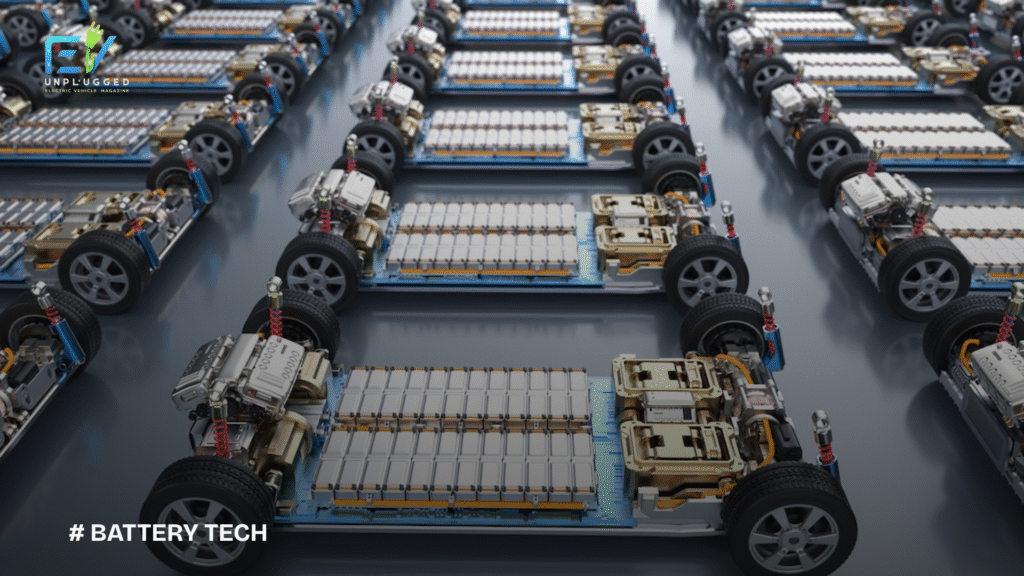

2. Invest in EV Battery Technology

EV battery investments are key, as battery cost and efficiency determine the future of the industry. Watch these players:

- CATL – Global leader in lithium-ion batteries, supplying Tesla and others.

- Panasonic – One of the oldest battery makers, a key Tesla partner.

- QuantumScape (QS) – Developing next-gen solid-state batteries, potentially game-changing tech.

3. Invest in EV Charging Infrastructure

With more EVs on the road, charging networks are a must. Companies in this space are scaling fast:

- ChargePoint (CHPT) – A North American leader in EV charging station infrastructure.

- Blink Charging (BLNK) – Rapidly expanding across U.S., Latin America, and Europe.

- EVgo (EVGO) – Focused on ultra-fast charging and public access stations.

4. Invest in the EV Supply Chain and Raw Materials

Battery production depends on materials like lithium, cobalt, and nickel. Investing in these commodities means getting in on the foundation of the industry:

- Albemarle (ALB) – One of the world’s largest lithium producers.

- Livent Corporation (LTHM) – Focused on lithium hydroxide used in advanced batteries.

- MP Materials (MP) – Supplies rare earth magnets used in EV motors.

How to Invest in the EV SectorYou don’t need to pick just one stock. Here are diversified approaches:

Individual Stocks – Great for investors with high risk tolerance and sector knowledge.

EV ETFs – Try funds like Global X Autonomous & Electric Vehicles ETF (DRIV) or iShares Self-Driving EV and Tech ETF (IDRV) to spread your risk across the industry.

Green Mutual Funds – Look for funds with strong exposure to renewable tech and EV innovators.

What Are the Risks?

Like any high-growth sector, EV investments come with volatility. Consider:

- High competition in the market

- Raw material shortages affecting production

- Regulatory shifts or delays in infrastructure

Final Thoughts: Is the EV Sector a Good Investment in 2025?

Absolutely. With clear policy support, rising demand, and rapid innovation, investment opportunities in the EV sector are set to grow even more in 2025 and beyond. Whether you’re buying EV stocks, battery companies, or charging infrastructure, this is a space full of long-term potential.

English

English