Why South India Leads EV Adoption: Insights & What It Means for the Rest of India

India’s electric vehicle (EV) journey is picking up pace, but South India is clearly at the forefront. With nearly 45% of the nation’s EV sales coming from this region, it’s becoming India’s EV stronghold Entrepreneur. What’s behind its rapid rise, and how can the rest of India learn from its playbook?

Factors Driving South India’s EV Adoption

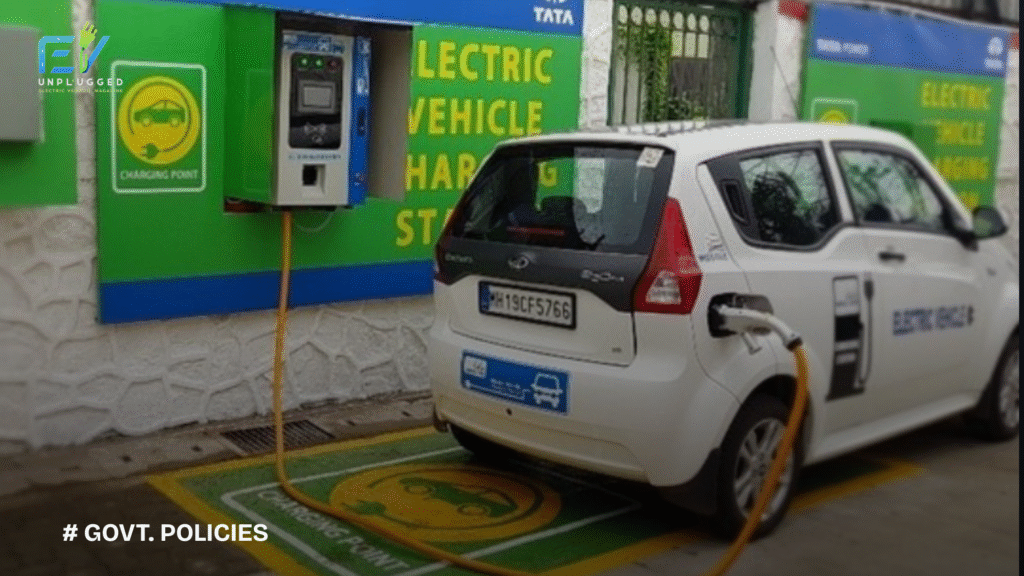

1. Progressive State EV Policies

- Karnataka introduced India’s first Electric Vehicle & Energy Storage Policy in 2017, attracting players like Ather and Ola. EV registrations surged from 9,703 in 2020 to 1.59 lakh in 2023-24, a staggering increase

- The state now boasts the highest number of public EV charging stations in India—5,765, with over 4,462 located in Bengaluru alone

- Telangana’s EV Policy (2020) and Tamil Nadu’s industrial incentives for EV manufacturing are key pillars supporting the region’s growth.

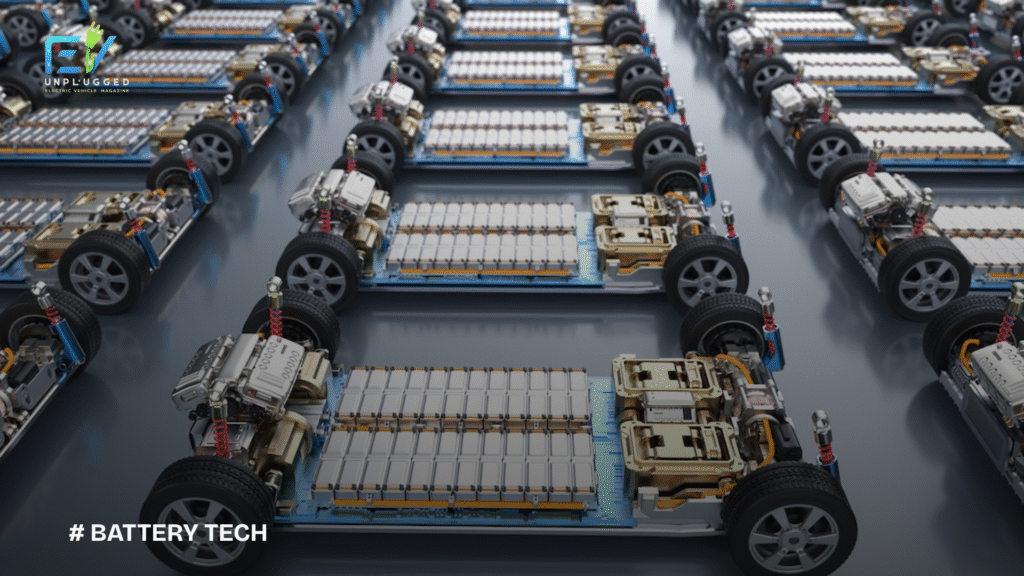

2. Manufacturing & Supply-Chain Ecosystem

South India—including Chennai, Bengaluru, and Hyderabad—serves as an EV manufacturing and R&D hub. Notable examples:

- Ather Energy’s 110,000-unit scooter factory in Hosur, Tamil Nadu, along with its “Ather Grid” fast chargers in 18+ cities.

- VinFast’s $500M EV plant in Thoothukudi, Tamil Nadu, slated to produce 50,000 EVs annually, expanding soon to 150,000.

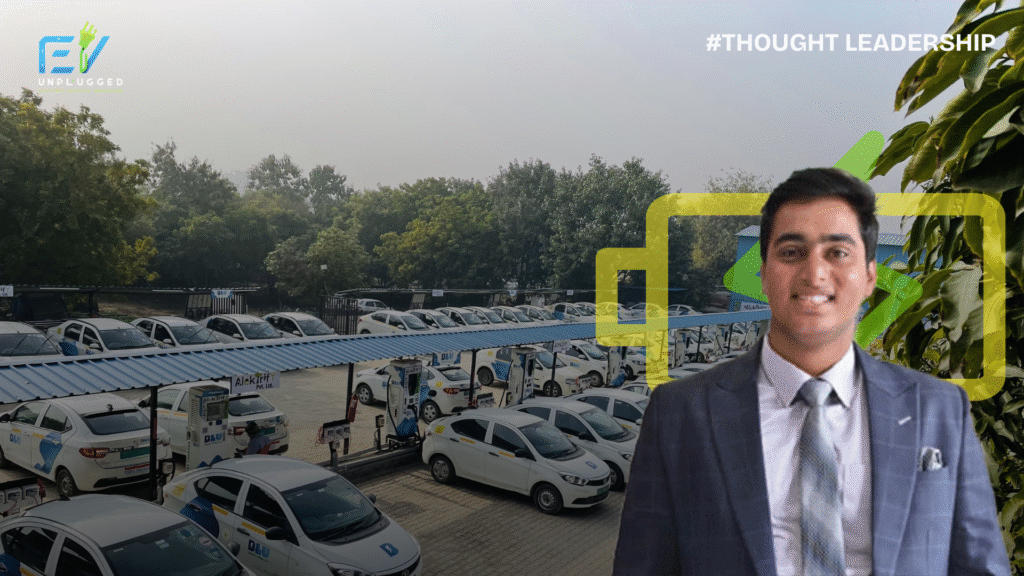

3. Charging Infrastructure Leadership

South India leads in charging infrastructure:

- Karnataka leads the nation with 5,765 public charging stations, accounting for 23% of India’s total, as of late 2024.

- India’s public charging network grew to 25,202 stations by 2024—a ninefold increase from 2022, driven by schemes like FAME-II and private players.

- Innovation continues: Bengaluru-based Exponent Energy unveiled a 15-minute full-charge station, further boosting infrastructure accessibility.

4. Urban Consumer Awareness & Adoption

- Cities like Bengaluru, Chennai, and Hyderabad feature tech-savvy, eco-conscious consumers who readily embrace EVs—particularly two- and three-wheelers.

- In Andhra Pradesh, despite challenges, EV registrations hit 1 lakh vehicles by mid-2025, with two-wheelers making up ~85%.

- Contrast this with Andhra Pradesh’s low adoption rate of just 1.85% of new vehicle sales being EVs between 2019–2024 The Times of India—highlighting the gap other states must bridge.

What This Means for the Rest of India

- Policy Emulation: States in the North, East, and West can adopt South India’s holistic approach—EV incentives + infrastructure rollout + EV manufacturing hubs.

- Expand into Tier-2 & Tier-3 Cities: To ensure equitable EV access, smaller cities and towns must receive charging stations and financing support.

- Fleet Electrification Opportunity: North Indian cities like Delhi, Pune, Lucknow can mirror Bengaluru’s surge in EV delivery fleets—powered by startups and local manufacturing facilities.

Key Takeaways

- South India is India’s EV testbed, combining visionary policy, robust infrastructure, and manufacturing strength.

- Nearly half of India’s EV sales—45%—come from South India, underscoring its dominance .

- India registered 36.4 lakh EVs (3.38% market share) between 2019–2024, with Karnataka among the top states.

- India tallying 19 lakh EVs sold in 2024, paired with massive infrastructure expansion, signals synchronized growth.

Conclusion

South India has transformed itself into the launchpad of India’s electric mobility revolution, with visionary government policies, manufacturing clusters, and superior infrastructure. For EV adoption to truly go national and hit targets like 30% new car sales by 2030, the “South model” offers a scalable and replicable framework.

What do you think other Indian states must prioritize—policy, charging infrastructure, or consumer awareness—to catch up with South India’s EV success?

English

English